Acquisition project | Fibe.India (Formerly EarlySalary)

Pretext:

- Journey on multiple platforms seems identical & allows for similar experience.

- Experience on the other hand, as an overall entity, is definitely a mixed bag. There are some harsh reviews as well around, multiple platforms (Google, youtube, mouthshut, etc). Whereas, there are a lot of overwhelmingly happy reviews as well! (Quora especially showed that people find us a one of the best in the industry.)

- Consumers of financial tools are not quite up to date with industry practises which also leads to confusion >> Bad reviews

Growing Acquisition @ Fibe

To get started, we can chart out two ICPs to get a grasp of what customers are we to cater to & how are we to acquire them for our current offering.

ICPs:

ICP 1 | ICP 2 | |

Ideal customer profile name | Harsh | Ajay |

Age | 27 | 32 |

Goals | Cater to monetary needs | Fund their large purchases through EMIs |

Income levels | 32K/month | 45K/month |

Gender | Male | Male |

Location | Mumbai | Bengaluru |

Companies | TCS | Medibuddy |

Marital Status | Single | Married |

Where do they spend time? | Digital: Insta, Youtube, Amazon, Swiggy, Prime, etc Physical: Work, Local malls, Street Vendors | Digital: Facebook/Insta, Youtube, Amazon, Prime, Netflix, Zomato etc Physical: Work, Local malls, Marts & Stores, Street Vendors |

Pain points | - Unforeseen monetary need - Low or now rainy day savings - New to credit, mismanagement of finances | - No access to Credit cards - Non availability of limit on cards - High IRRs |

Current solution | Family, friends, banks/NBFCs | Save & Purchase / Buy lower version / |

Influencer / Blocker | unforeseen & exegency - Dependents from family / Financial burden, uncertainties about future, lack of knowledge about product | Growth (Upskilling, Future Planning, Long term purchases or investments) / Additional costs, uncertainties about future, lack of knowledge about product |

// Unsecured personal loans jumped 4-fold to Rs 13.3 lakh cr from FY17 to FY23 - ET Money //

Keeping that growth in mind, the total addressable market in FY25 would be ₹20 Lakh Crores - From there, let's assume 5% market share as Serviceable Addressable Market (SAM) & 10% of the SAM as Serviceable Obtainable Market. Mentioning the same below in the form of a table:

TAM | 2000000 Cr |

SAM | 100000 Cr |

SOM | 10000 Cr |

While going through our top competitors, MoneyView, Cashe, & KreditBee, the keywords that popped up often were:

Easy Loans, Quick Loans, Personal Loan, Amounts/values, Instant Loans, Loans, Free Credit Score, Online Loan, Credit Line, Fast Loans

This gives us an idea of what our customers are getting attracted to. To summarise, they key pitch is around:

- Speed

- Value delivered

- Ease of transaction

Sub text can also be designed to ensure our communication is aligned to the ICPs drawn:

- Cheaper than market - Lesser burden

- Building trust by honest communication - Fear of being tricked

- Flexibility - Amount, Payments, Foreclosure, etc

To further understand the customer better, let's define the jobs that the customer needs to do with us and the goals he/she is trying to achieve through it. When it is about Fibe, consumers focus on two major jobs, as mentioned below:

Job | Comment |

Functional | They wish to avoid monetary distress at the moment |

Financial | They wish to spread out their monetary obligations over a period to achieve financial stability |

This leads to us defining the core value proposition of the organisation: Providing Instant Loans @ Affordable rates

Keeping in mind that Fibe is @ a mature scaling stage as an organisation, let's chart out the channel priority matrix:

| Cost | Flexibility | Effort | Lead Time | Scale |

Performance | High | High | Low | Low | High |

Affiliate | Medium | High | Medium | High | High |

Aggregators | Medium | High | Medium | High | High |

Organic | Low | Low | High | High | Medium |

Referrals | Low | High | Medium | Medium | Medium |

Partnerships | Low | High | High | High | High |

With that, we can conclude that the two winners are Performance & Referral as a channel -

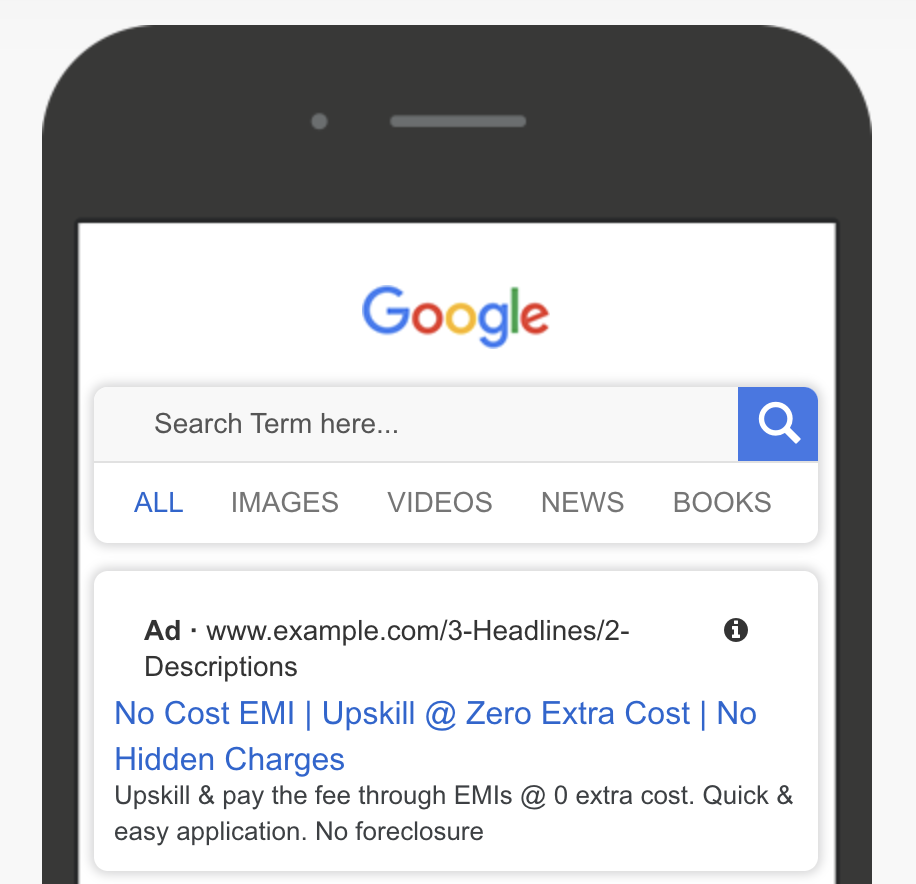

Performance Marketing: Google Ad - Since customers who are in distress generally search about solutions

First Campaign

- ICP Chosen: 1st Profile (Harsh)

- Customer looking for a personal loan to solve their current trouble of money crunch

- Marketing Pitch: Quick & Easy Loans - No Hidden/Extra Charges

Second Campaign

- ICP Chosen: 2nd Profile (Ajay)

- Customer looking for EMI options for their upskilling fee (Eg: Upgrad course)

- Marketing Pitch: Upskill @ Zero Cost EMI - No Hidden/Extra Charges

Referral Program:

- Brag Worthy: Quick Access to money as and when needed - Allows customer to feel more secured in terms of financial needs - an extra line of credit

- Platform Currency: Money & Access

- Money: It can be further divided into Fibe Coins (That allow users to get discounts on our offerings, Money vouchers of other brands, etc) & actual Money in a form of cashback

- Access: Fibe has Vikrant Massey, Indian actor, as its brand ambassador. He has a following of 2.5Mil on Instagram. Access to VMs signed items as collectibles can be a higher level goal for each customer who is actively referring more than others

- Based on analysis: Younger users (aged between 25-30), who use credit lines more than usual customers (Called Thick CC) are more inclined towards referring others than older customers. There are no geographic implications. As per happy flow, they are more willing to refer right after their disbursal has been a success - Money has been credited to their account

That is when the core value prop has been felt by the customer - Product has successfully delivered what it promised - Money into customer's account - Discovery of the program needs to be done through various touch points. The first major touch point to be when the customer successfully disburses the amount & provides us with a NPS score. Post this there can be other touch points created as well through other products, home dashboard & Nurturing activities through various communication channels like: SMS, Whatsapp, Emails, etc

Mentioning a table below to map out how we will reach out to customers and get them to refer

Discovery | Awareness | Desire | Action |

Success Screen of Loan & Repayment | Marketing Screens | Favourite contacts | Refer Now |

Other product pages | Nurturing Comms - Email | 300 contacts of yours are not on Fibe (Earn by referring) | Remind Friend |

Home Dashboard | Search button for contact | Claim bonus | |

Nurturing Comms (SMS/Email/WA) | Calculate your rewards | |

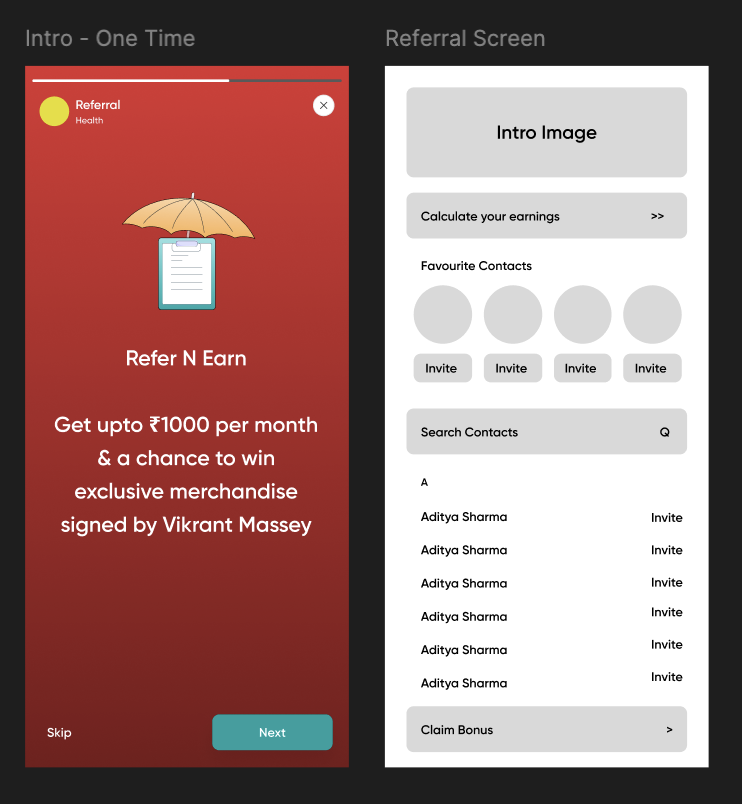

Screenshot of high level wireframes to get a grasp of the program:

- To share the referral link, the customer would have to find the contact and send a customised referral message for the referee. This would be a 1-1 Whatsapp message with an image that shows a voucher of ₹300 - Message to say:

"Hey Aditya, here's ₹300 off with Fibe from me whenever you use their credit line next! Just use my link & code to register yourself on the Fibe App. Code: UMANGY Link: www.fibe.in/app" - To track their referrals, the referrer would have to click on claim bonus and see where their friend has reached in the referral journey - referrer could remind the referee if they haven't taken desired action to get the referral bonus for referrer

What are the bonuses and checkpoints:

1. Sign up: Referrer gets FibeCoins

2. Approval of limit: Referrer get's Money which needs to be claimed by taking action - Either cash or select brands vouchers of more value than cash benefit

3. Disbursal: Referee get's ₹300 off from processing fee - To ensure that the referrer continues to refer - we use the following:

- Calculate your earnings with Fibe: Get to know potential and see what you have earned

- Claim bonus success: Nudge the customer to get higher value by referring more on success of claiming existing bonus

- Favourites: Showcasing favourite contacts of the customer and nudging them to invite them on app (Making it easy to invite select friends)

- Milestones: Having a larger milestone that if chased, referrer gets a larger reward

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.